Residential Development Finance

Residential Development Finance

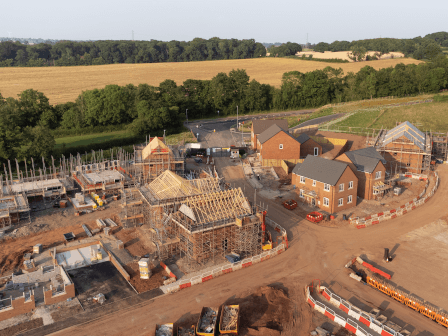

Residential development finance is a short-term loan used to assist businesses with the fundable costs of different types of residential development work. That could be property conversion, a substantial refurbishment project or building homes from scratch.

What is Residential Development Finance?

Residential development finance is a short-term loan used to assist businesses with the fundable costs of different types of residential development work. That could be property conversion, a substantial refurbishment project or building homes from scratch.

Whatever the type or scale of your proposed venture, our residential development loans can help your home building business get projects off the ground and see them through to completion. We offer a bespoke residential development finance product to suit a variety of projects.

The property types permitted for residential development finance are conversions, refurbishments and new build houses, studios and apartments in low and high rise blocks.

Get in touch

Our expert team is here to guide you through your journey. Tell us about your needs, and we will be happy to help.

If you already have a relationship with one of our team members please visit, Meet the team.

How does it work?

Residential development loans operate in stages. Initial funding is for the purchase or refinance of the development site.

The second stage concerns the fundable cost of the project’s building work, associated professional fees and finance costs. Again, that will depend on the type of development project. For new homes it’s the building of the properties, whereas for conversion and heavy refurbishment, that means work done within the property. Funding is then released against monitoring surveyor reports.

The property types permitted for residential development finance are conversions, refurbishments and new build houses, studios and apartments in low- and high-rise blocks.

Who is it for?

Residential development finance is for SME home building businesses to raise capital to invest in their property development projects. These short-term development loans are designed to be repaid on project completion, sale or can be held as an investment asset.

Residential development finance is for SME home building businesses to raise capital to invest in their property development projects. These short-term development loans are designed to be repaid on project completion, sale or can be held as an investment asset.

To qualify for residential development finance, home building businesses can be individual developers, partnerships, UK corporate entities and UK-based ultimate owners, that are experienced developers with a demonstrable track record with similar sized units and assets.

Residential development loans require security. This can include personal or corporate guarantees, first legal charge over the property, mortgage debenture over the borrowing company, collateral warranties, assignment over build contract, and other security as required.

Other things to know when considering residential development finance include property tenure, which will be freehold or long leasehold of over 80 years at expiry of the Loan. A minimum of 10% cash contribution is required from the borrower. Also, we will consider a small commercial aspect to a proposed residential development project.

Key features

| Facility type | Fully-funded development loan — equity release considered on land purchase and planning gains |

|---|---|

| Loan range | £2,000,000 - £45,000,000 |

| Max term | 36 months |

| Drawdown | Funds released monitoring surveyor reports |

| Repayment | Rolled interest bullet repayment on exit |

| Max LTC | 80% |

| Max LTGDV | 65% |

| Fees | Arrangement, exit and professional fees payable |

Lending criteria

Property types

- Permitted development and new build units including houses, studios, and shared apartments in low or high rise blocks

Borrower types

- Individuals, partnerships and UK corporate borrowing entities

- UK-based ultimate owners

- Experience demonstrable track record

Security

- First legal charge over the property

- Collateral warranties

- Debenture over the borrower

- Assignment over build contract

- Personal or corporate guarantees

- Other security as required

Tenure

- Freehold or long leasehold (60+ years remaining upon completion)

Other things to consider

- We support the UK Government’s nationally described space standards

- We expect a minimum cash contribution from the borrower of 10% of total cost

- There may be a small commercial aspect to the development

Applying for Residential Property Finance

A property development loan will be based on the viability of your project and your business experience as a residential developer. In other words, your project’s potential to produce revenue and profits must be demonstrated. Finance will also be subject to the appropriate planning permission being held. The following steps outline the application process:

A property development loan will be based on the viability of your project and your business experience as a residential developer. In other words, your project’s potential to produce revenue and profits must be demonstrated. Finance will also be subject to the appropriate planning permission being held. The following steps outline the application process:

- An on-site visit to discuss your requirements

- We provide our non-credit backed heads of terms

- If you’re satisfied with our terms, sign and return

- We submit to credit and receive sanction

- Solicitors and valuers review all the legal requirements

- You’re ready to drawdown your loan

How we can help you?

We’re dedicated to helping you achieve your development goals with lending solutions tailored to meet your specific project needs.

We’re committed

We are committed to providing funding to help small to medium sized property developers and investors in the UK.

We’re responsive

Our experienced team can deliver fast, flexible lending decisions.

We’re reliable

As an established, well-funded and capitalised UK bank we will support investors’ and developers’ needs as they grow.

We’re personal

Our relationship led approach means your Relationship Director will manage the process through the life of the loan.